Shared ownership mortgage how much can i borrow

On top of this monthly mortgage payment youll also need to pay a monthly rent to the housing association. This multiplied by the answer to third question gives the maximum mortgage you are likely.

:max_bytes(150000):strip_icc()/dotdash-refinancing-vs-home-equity-loan-v2-7581ca7e240847fb972ef6efee18492e.jpg)

Cash Out Refinance Vs Home Equity Loan Key Differences

Theyre also known as part buy part rent mortgages and are offered by housing associations.

:max_bytes(150000):strip_icc()/dotdash-refinancing-vs-home-equity-loan-v2-7581ca7e240847fb972ef6efee18492e.jpg)

. Shared ownership mortgage how much can i borrow Sabtu 03 September 2022 Edit. Before we can buy a place together we need to work out how much you can afford based on your income and outgoings. Shared Ownership Mortgages Freephone 0800 092 0800.

Thats where shared ownership mortgages can help. This is worked out as a percentage usually between 2 and 3 of the share. Calculate what you can afford and more.

Mortgages are secured on your home. Total monthly credit commitments - eg. If you want a more accurate quote use our affordability calculator.

Total of service charge and rent. Maintenance payments andor childcare costs. With just a few quick questions our online mortgage calculator will give you an idea of how much you could borrow show your mortgage rates and compare.

The buyer purchases a share of the. A shared ownership scheme enables a prospective house buyer to purchase a property with 100 ownership whilst only paying a percentage of the market value. A shared ownership and rental calculator will help you determine the monthly repayments for your loan and your rent.

You could lose your home if you do not keep up payments on your mortgage. Bank loans hire purchase catalogues. Answer a few simple questions and well help you to work out how much you could afford to borrow.

You can buy additional shares in 1 instalments instead of the former 5 or 10. Well also give you an idea of what your monthly payments might be. For example the minimum deposit and income requirements for a 230000 home are.

The shared ownership scheme allows people to buy a share in their home even if they cannot afford a mortgage on the entire value of the property. The first step in buying a house is determining your budget. The minimum amount of share you can have in a property has reduced from 25 to 10.

First you input the propertys total price your deposit how much you need. But we strongly suggest that if you have not yet approached a lender the default number to use is 4. Get a quick quote for how much you could borrow for a property youll live in based on your financial situation.

Think carefully before securing other debts against your home. The amount you can borrow depends on how much deposit you have your credit history and your finances. This mortgage calculator will show how much you can afford.

YOUR PROPERTY MAY BE REPOSSESSED IF YOU DO NOT KEEP UP REPAYMENTS ON A MORTGAGE OR ANY DEBT. The decision that the calculator gives you is a guide only and not the. How much can I borrow for a mortgage.

Fill in the entry fields. Thats where shared ownership mortgages can help. Shared ownership mortgages could allow.

This percentage is interest-free. 50 share requires a 5 deposit which equates to 5750 and a minimum income of 27600 and.

Pin On Mortgage Madness

A Collection Of Latin Maxims And Phrases Literally Translated Intended For The Use Of Students For All Legal Examinations Cotterell John Nicholas Free Do Latin Maxims Maxim Phrase

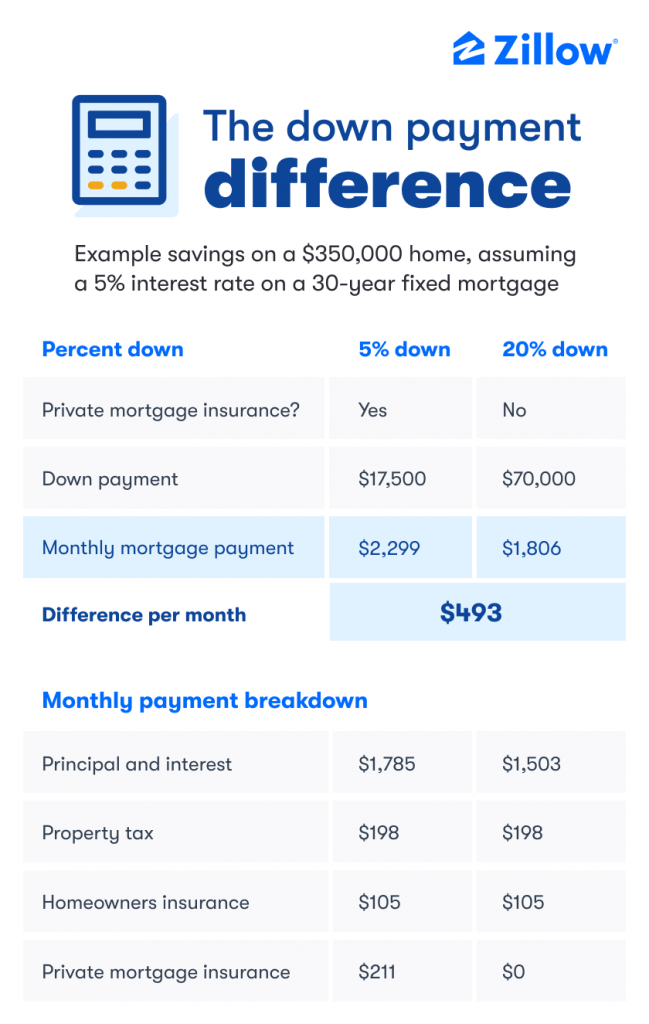

How Much Is A Down Payment On A House Zillow

Reverse Mortgages What To Know Visual Ly Reverse Mortgage Mortgage Info Mortgage Marketing

How To Read A Monthly Mortgage Statement Lendingtree

Pin On Housing Market

Cristina Ferrara On Instagram Mortgage Interest Rates Have Dropped Considerably Over The Past Year Locking A Mortgage Interest Rates Interest Rates Mortgage

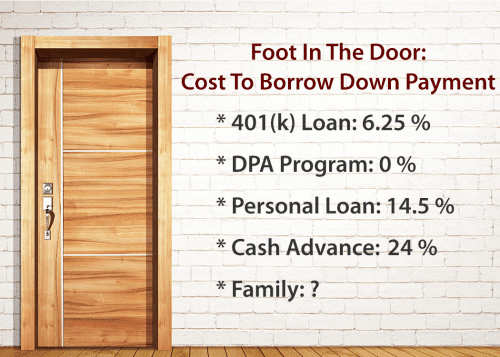

How Do Lenders Know If You Borrow Your Down Payment Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Mortgage Affordability Calculator Trulia

What Is A Reverse Mortgage Money Money

Borrowing Power Calculator Sente Mortgage

:max_bytes(150000):strip_icc()/dotdash-prequalified-approved-Final-0ec9b95c27ba4354a00f49817d0810dd.jpg)

Pre Qualified Vs Pre Approved What S The Difference

/dotdash-prequalified-approved-Final-0ec9b95c27ba4354a00f49817d0810dd.jpg)

Pre Qualified Vs Pre Approved What S The Difference

/dotdash-prequalified-approved-Final-0ec9b95c27ba4354a00f49817d0810dd.jpg)

Pre Qualified Vs Pre Approved What S The Difference

How A Change In Mortgage Rate Impacts Your Homebuying Budget Mortgage Rates Budgeting Mortgage

Steps To Buying A House Buying First Home Home Buying Tips Home Buying

Key Terms To Know In The Homebuying Process Infographic Real Estate With Keeping Current Matters Home Buying Process Home Buying Real Estate Terms